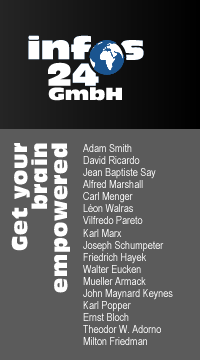

one | two | three | Cuatro

2. neoclassical economy

3. Karl Marx

4. Joseph Schumpeter

5. ordoliberalism

6. keynesianism

7. critical rationalism

8. philosophical criticism

9. monetarism

We will see in this chapter that the "marginal revolution", the assumed scientific advance of neoclassical theory, never happened because Adam Smith argues already with a marginal concept. Secondly, it is seen as a big advance that the neoclassical theory explains the value of a good with the preferences of the people. The problem is that the opposite opinion that the value derives from the costs only, is only shared by David Ricardo, but not by Adam Smith as we will see.

Textbooks about micro-economics are mostly a simplified version of the concepts of Alfred Marshall. It would be less expensive and more useful to use the original work, Principles of Economics of Alfred Marshall. Although almost all the concepts we find in modern textbooks are from Alfred Marshall, there is a difference. Alfred Marshall distinguishes between tendency and law.

The word law, in the meaning of natural law, implies that there is stable relation between cause and effect and that this relation is universally valid. The world tendencies only implies that there is a relationship between two effects, not between the cause and the effect. There is for instance, a relationship between price and amount, but the price is not the cause. The price is the effect of the underlying economic structure. That means that besides the effects, there are other parameters to be taken into account.

In this case, when it comes to discussing real problems, we are not interested in the price/cost <=> amount relationship. When it comes to discussing real problems, we are interested in the underlying economic structure.

There are only few survivors of the classical theory in modern textbooks. Some of the few examples are 'the invisible hand' of Adam Smith, although Adam Smith didn't invent the term, the 'law of Say', although the original form is more complicated and the comparative costs of David Ricardo, although they are irrelevant in practise.

Neoclassical theory is considered as a new model of economic thinking, although by reading the original texts carefully, nobody would get this impression. What is really new in economic thinking, the Vilfredo Pareto and the Léon Walras abracadra, would be better silently ignored.

If we put "marginal revolution" in google, with quotes, we get 540,000 results. That's a lot for something that actually doesn't exist. It seems that nobody reads the original texts.

Keynes doesn't distinguish between classical and neoclassical thinking. There are a lot, as already mentioned, see perfect market, of reasons to find the distinction between classical and neoclassical thinking little useful. Related to the Keynesian criticism on economic thinking, the distinction between classical and neoclassical theory is irrelevant, concerning capital, money, type of interest, employment all share the same erroneous conceptions.

To understand new tendencies like the liberalism, neoliberalism, ordoliberalism, monetarism, Austrian school, Keynesianism some understanding of classic theory is needed. In order to undertand the basis of these tendencies, we must know what free market economy means, optimal allocation of resources, what is the classical concept of saving, the function of the type of interest, the role played by money, the effects of taxes on allocation, distribution etc. We find all that already in Wealth of Nations. The methodological approach of these tendencies is similar to the one used by Adam Smith. Neoclassical thinking, if we understand by neoclassical the methodological approach, mathematical modeling, the Vilfredo Pareto and Léon Walras abracadabra are irrelevant outside the academic sphere.

A real progress of the neoclassic theory, this is valid for all authors nowadays considered neoclassical, is the fact that the classical production factors, labour, capital and land, where reduced to one- expenditures. In other words, whatever production factor generates cost, it is only considered as costs. The supply curve doesn't distinguish between the different kind of costs. They are just costs.

This is actually an improvement. It is well possible that it rains a lot in England and therefore, Adam Smith or David Ricardo never realised that water can be scarce. Normally they have to much of it. However, at a global level, land is no problem, not at all, it exists in abundance. What is actually scarce is fresh water. Besides that, the land is actually not very important. The productivity of the land depends on the know how. In the dependence of know how, fertiliser, intelligent concepts against parasites the same amount of land can have very different revenues. Besides that, the production of food is not the problem. The problem is transportation, cooling and conservation.

However, although Adam Smith knows only three productive factors, labour, capital and land, he describes in a sufficiently exact way that they have a tendency towards the optimal allocation. (For a lack of perfect information, the optimal allocation will never be obtained, but the best allocation under imperfect information will be obtained.) It is no problem to expand his ideas to the thousand of existing productive factors and to specialised capital and workforce. If a productive factor is paid with natural price, we got the Walrasian equilibrium.

If in one sector of the economy a productive factor can earn more, he will move to that sector until the income is the same everywhere.

This is a marginal consideration. With every unit that moves from one sector to the other, the profitability in the sector it moves to diminishes and the profitability in the sector it moves out increases. This proces is stopped when the profitability of the last unit is the same in both sectors.

The problem with Léon Walras is that his assumptions, perfect market with perfect information, no transaction costs, immediate adaption to new circunstances, restriction to a market where goods are only exchanged but not produced, are so obviously unrealistic that the true core gets lost.

In a market economy, there is tendency to obtain the best possible allocation of resources under the condition of imperfect information. If we assume perfect information, we get the optimal allocation, but unfortunately, this is not the world we are living in.

This makes a big difference. A very big difference. We have actually, in a market economy, a tendency to the best possible allocation of resources. This is historically proven. If someone has lost the change to visit East - Germany immediately after the fall of the wall, he can go to Cuba. Léon Walras assumes that information processing is not needed. The resources flow automatically to the most profitable use and with a little bit of math and some equations, the total equilibrium where all resources are used in the most profitable way, can be determined.

The difference between Léon Walras and Karl Marx is that Léon Walras believed that the problem can easily be solved by some equations. Karl Marx believed that the allocation of resources is so trivial, is such a trivial problem that there is no need to think about it. History shows that the problem cannot be resolved with some equations and that the problem is everything but trivial. When the followers of Karl Marx and Vladimir Ilyich Ulyanov alias Lenin, they became aware that a coordination process is needed. Then they created a lot of equations, much more than Léon Walras, but with little success.

A lot of people believe that the financial crises of 2008 was a failure of the free market. That is difficult to understand. Stock markets have nothing in common with a market. In a market, there are suppliers and consumers. In the stock market, there are no consumers and only investors. Investors in the stock markets don't care about consumers, they are inexistent in this market. The basic idea of a free market economy, to serve the consumer, is irrelevant in this sector of the economy.

The financial sector has an heavy impact on the economy, but is not a market in the sense of Adam Smith. We will discuss the topic in the chapter about Keynes. A summary can be found in the little book about Keynes downloadable from the start of this website.

(Actually, there is difference between the concept of Alfred Marshall on one side and the concept of marginality of Léon Walras and Adam Smith. In theory, Alfred Marshall is right. Even the marginal supplier, whose marginal costs equals the price, makes a profit, because the costs of the units before are lower than the price. Mathematically speaking, Alfred Marshall works with the first differentiation of the cost function. Léon Walras works only with equations, that means that in his total equilibrium, the entrepreneur doesn't make any profit. We have a similar situation in the case of the natural price. In this case, the price is high enough to pay the wage, the profit on capital and the rent, but the entrepreneur doesn't make any profit. This theoretical difference is irrelevant in praxis.)

| When the price of any commodity is neither more nor less than

what is sufficient to pay the rent of the land, the wages of the

labour, and the profits of the stock employed in raising, preparing,

and bringing it to market, according to their natural rates, the

commodity is then sold for what may be called its natural price. Book II, Chapter VII |

It is often said that in classic economic thinking, the value of a good derives from the costs needed to produce it. This is true for David Ricardo and his follower Karl Marx, but not at all for Adam Smith and still less for Jean-Baptiste Say.

The market price has nothing to do with the costs. It depends entirely on the demand. The market price can be higher or lower than the natural price. In the first case, resources will pour in this sector, in the second case they will pour out.

David Ricardo affirms, under some strange assumptions, that the price depends completely on the costs. However, even if we agreed with his assumptions, wages will never exceed the minimum vital, his arguments are false. In this case, wages never exceeds the minimum vital, it would be true that the price of a good would be determined by its costs, but the demand would decide what is produced.

Karl Marx feels no need to justify his thesis, that the price is fixed by the costs. Not in theory and not in practice. In the deceased East-Germany, the price was the equivalent of incorporated labour. The prices were very strange. Bread was cheaper than corn and therefore, the pigs were fed with bread. (That's not a joke!)

return to the tip of the page ...

In the notion of natural price is implicit the idea of marginal costs. Resources are realocated until the profit of the last unit is the same everywhere

The natural price is the price that covers all the costs of the three productive factors. The wage for the labour, the profit for the capital and the rent for the land

The natural price is the price paid for a productive factor in perfect equilibrium, no reallocation is necessary nor useful, in other words the (monetary) marginal revenue of the last unit is the same everywhere