one |

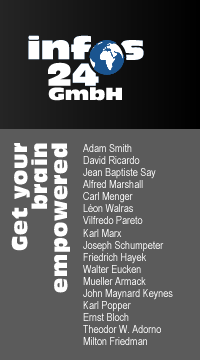

1. classical economy

2. neoclassical economy

3. Karl Marx

4. Joseph Schumpeter

5. ordoliberalism

6. keynesianism

7. critical rationalism

8. philosophical criticism

9. monetarism

The author of this website is German. Since World War II the Germans have been discussing, without much result, how it was possible that barbarity got into power in 1933. The answers given by Friedrich Hayek, an economic interpretation of the phenomena, are ridiculous. The problem is much more complex. We will discuss this topic again and again throughout this website.

Economic arguments are always used to justify an ideology. From a superficial point of view the Cold War was a conflict between two different economic systems, although the economic arguments are always mixed with issues that have actually nothing to do with economics. The idea of linking free market economy to freedom, as Milton Friedman does in his book Capitalism and Freedom, is not really new. The entire Cold War was about defending freedom on the one hand and fighting imperialism on the other.

The entire Cold War was about defending freedom on the one hand and fighting imperialism on the other.

This website is not about history. We will not discuss here all the issues related to the Cold War, Vietnam, Chile, Nicaragua, Guatemala, Cuba, the Prague Spring, the invasion of the Baltic States, Russian dominance in Poland and other countries of the Eastern Bloc.

It seems that ideology always needs something additional, a higher goal, to take shape and that other justifications always mask purely economic interests.

Public discussions about economic issues are always confused with non-economic issues and, in times of crisis, the public sphere is more and more dominated by non-economic issues that have nothing to do with economics, as we can see right now, with the rise of nationalism in different European countries.

At the same time, this fact has driven many throughout history to obtain things that for economic reasons alone would not have been achieved. .

During the so-called Siglo de Oro period in the 16th and 17th century, Spain for instance, sought to obtain more gold by colonizing South America. From their point of view, this was logical. Gold was the standard means of payment all over the world. The more someone had of it, the richer he was. It was, therefore, a good idea to conquer South America and to ship all gold found there back to Spain.

What happened in the 17th century could have been predicted. The more gold was shipped to Spain; the more prices increased. This is not a necessary consequence as we will see later on when discussing Keynes, but if supply cannot be increased in response to higher demand, prices will rise.

In the case of Spain, the response was even worse. The balance of trade became more and more negative, and American gold created jobs in England and France, but not in Spain. The wealth of a nation depends on their skills to produce things, not on the means of payment.

In other words, the conquest of South America was based on an erroneous economic idea, and ultimately Spain was worse off than at the beginning. This error in economic thinking, which costs the lives of millions of people and lead to the destruction of entire cultures, did not give Spain any advantage over the long term.

What happened could had been predicted. Anything can serve as a means of payment, provided that for natural or legal reasons it is scarce, easy to transport and can be subdivided into small units. The best means of payment is therefore printed paper, which is maintained scarce by governments.

A similar case is the so-called "Third Reich". (We focus on the economics aspects, but this does not mean that these aspects are the relevant ones in this case.) This foolish Austrian believed that more land was needed in the East. We can assume that he had no intention to establish a Golf Club there. The question arises of what he wanted to do with all this land. The reality we are confronted with nowadays is that farmers get money from the European Community if they STOP cultivating their land.

The first who realised that the logic of the 'conquistadores' would not work was Adam Smith, but we will see that only his friend David Hume understood the problem entirely. It is actually possible to increase economic activity through an increase in the amount of money circulating, although this does not work the way the Spaniards in the 17th century imagined. It only works if increased demand can be satisfied. The increase in the amount of gold in the 18th century led to an increase in economic activity, something realised by David Hume, see balance of trade, but benefitted England, not Spain.

(By the way, Keynes sometimes likes to joke. He argues in favour of mercantilism with a sophisticated argument. If there is more gold circulating, interest rates, the price for money falls, and this increases economic activity. The argument itself is true, but it is to be supposed that this effect was an unexpected side effect of mercantilism, although that is the only thing that was correct in mercantilism.)

Public debates about economic issues are never neutral. Economics is discussed as if it were a set of causal chains, where a cause leads necessarily to a certain effect, as is the case in science. People also assume that political decision making on economic issues affects their interests. These presumptions can be wrong or right, but they always exist.

Right now, in 2014, people assume that the massive increase in the amount of money negatively affects their interests as savers. Obviously, interest rates decrease when more money is injected. Banks and other institutional investors will not depend on savers to generate money to invest (although, in most cases, institutional investors speculate on the stock market).

It is quite clear that limiting the amount of money increases interest rates. What savers forget is that if they get more for their money others have to pay more for their money and there will be fewer jobs because investment will decrease. People have the strange habit of only seeing the direct impact of something and not the indirect impact. The same thing happens with reductions in the unemployment rate through increases in export, which works in the short run, but not in the long run.

The same thing is true of consumption. Every government is happy when over Christmas, consumption increases and at the same time, they give incentives in order to encourage saving.

Public debate is dominated by personal interests or, more exactly, what people believe best suits their personal interests whereas often the same person takes positions which are incompatible.

By contrast, textbooks on economics try to present economics as a science with rules as stable and well proven as natural laws. The problem with these economic "laws" is that they are only true because they are trivial, even though mathematical modeling makes them appear very scientific. The issue is that the trivialities are irrelevant and do not address the real problems. The pareto optimum is true. People only change one good for another only if this makes both of them better off or, at very least, if the position of none of them worsens after the change. Mathematical modeling makes these so-called "laws" appear very scientific, but actually this insight is the result of pure "intuition".

But this is not even the real problem. The real problem is that economic textbooks claims to tell the truth, and this in itself is incompatible with democracy. The idea of democracy is to find out the truth by trial and error. It is for this reason that people have to understand what they vote for and why they vote for it (otherwise there is no learning process).In other words, trial and error only make sense if people do not repeat the error. Textbooks of economics claims to tell the truth. If the truth is known, no trial and error process is needed. Democracy becomes obsolete.

Democratic decision making is not necessary to determine whether the conservation of energy principle is true. (The link leads to a genius lecture on this principle. If this principle was not clear in school, it will be now. It is a question of life or death. See the video.) If we know the truth or if there is a direct way to discover the truth, for instance through an experiment, there is no need for democratic decision making.

The methodological approach of economics as described in textbooks is therefore not far away from being an ideology, and ideologies do not search for the truth, as they have already found it. Moreover, if someone feels himself to be in possession of the truth he does not see any need for democratic decision making. We will discuss this topic again when talking about Karl Popper.

Why it is impossible to know the truth related to economic issues? It is impossible because economic "laws" never describe stable relationships between causes and effects as is suggested by these laws. These laws abstract from everything that is not part of the system. In general from everything that cannot be modelled.

An affirmation, such as "the wage corresponds to the (monetary) marginal product of labour" actually tells us nothing if variables (for instance, the education system, technical progress, political system, change in the size of the market, change of preferences and so on) have an impact on the marginal revenue of labour. If we assume that all these variables are stable, as neoclassical authors do, the only way to reduce unemployment is to lower wages. If we assume that they can be changed, there are a lot of possible options.

With every change in the technical structure, technological progress, the appearance of new competitors or competing countries, or changes in the size of markets, changes must be made to the distribution system and the economic system.

In some countries, for instance, the pension system is based on a 'contract between generations' in which the working generation pays for the pensions of the pensioner generation. This works if the relationship between working people and pensioners remains the same, but does not work if the population, as is happening today in many places, becomes older and older. The question of how the system must be adapted cannot be answered using simple models.

Economists like to present themselves as pure, disinterested scientists, free from all kind of ideology. We have to recognise, however, that they defend their own interests and react according to the incentives given by the system. They are more interested in publishing "scientific" articles in high impact journals as this is the only thing that is relevant for their economic career, than in resolving concrete problems. See Can this nut be cracked?.

Second, although economists affirm the opposite, the academic curricula for economics are almost the same all around the world. This is astonishing if we consider the large differences between the original authors on which economics textbooks are based.

(After having read this manual, the reader will realise that it is not really clear which concepts have been canonised and which have been forgotten.)

If we read the original texts we see big differences in the methodological paradigm, in the definitions of the terms used, in the parameters taken into account, in the aspects of economics being considered and in the supposed cause and effect relationships.

One could argue that this discrepancy is due to progress in "science", that incorrect concepts have been eliminated, as happens in any other science, and the correct ones were kept. This is not very plausible. If this were the case, notions such as capital, money interest rates ought to be clearly defined in today’s textbooks (see the little book about Keynes downloadable from the start site of this website. If we do not define clearly what we mean by these terms, the difference between Classic/Neoclassic theory and Keynesianism remains unclear.

It is much more plausible that there is a tendency to mask the differences without actually resolving the contradictions. In order to come to be regarded as a "real" science, it is more useful to show that there are no contradictions and that economics possesses some eternally valid truths. This can only be obtained through economic laws describing trivialities combined with mathematic modeling in order to give it a scientific appearance.

The problem is that discussions about real world problems cannot ignore these contradictions. If, for instance, we talk about saving in the real world, it matters if we are talking about capital, rather than non-consumed income of the past or money. There is no clear distinction between these two terms in Classical and Neoclassical theory, but there is a big difference in reality. For the student who wants to get credit at school, this does not make a big difference, but it makes a very big difference in the real world.

Ideologies are phenomena that are very difficult to describe. Generally, an ideology is described as a system of thought that tries to show that the interests of a certain group are identical with the general interests of society. Nobody would argue that the redistribution of income is bad because the rich get poorer. People who argue against the redistribution of income argue that big differences in the distribution of income are needed to increase the saving rates because otherwise there would be no incentive to work, that disparities in income are the result of objective market processes and so on. People who are in favour of redistribution would argue that it increases public demand.

However, all this does not explain why ideologies can penetrate the whole society. In reality, ideology is not really a system of thought. A system of thought may be criticised and its contradictions revealed. An ideology instead involves a standardisation of behaviour, terms used, and the acceptance of incentives given by the system. Its content, in other words, the presumed causal relationship between one thing and another, does not play any role.

After the fall of the Berlin Wall in 1989, the author worked for some months as a lecturer giving lectures to ex-professors of Humboldt University in the EAST of Berlin. These professors had lost their jobs after the fall of the wall. The author believed that there would be a lot of discussion about the difference between Marxism and the 'bourgeois economy'. However, this was not the case. They were not interested in knowing about the differences and still less in discussing them. However, what was particularly surprising was the fact that they had no clue of Marxism and that it was not necessary for East-Germany to know something about it to become a professor of economics.

Much more important than knowing the actual content was to master Marxist jargon. It was, for instance, not enough to talk about economic laws. They had to be referred to as “the objective laws of Marxism-Leninism”. Phrases such as this one actually meant nothing, but to dominate this kind of jargon requires training or brainwashing.

| Marxism-Leninism (is) the scientific system of philosophical, economic, and sociopolitical views that constitutes the world outlook of the working class; the science of the cognition and revolutionary transformation of the world, the science of the laws of development of society, nature, and human thought, the science of the laws of the revolutionary working-class struggle for the overthrow of capitalism, and the science of laws of the constructive activity of the working people in building socialist and communist society. Marxism-Leninism |

The prevalence of jargon is much better proof that someone is completely permeated by an ideology than any debate about the content of an ideology. A rational debate requires that someone raises doubts even if the critical reflection leads to confirmation of the system. A critical reflection means that someone assumes that it could be that the system is not logically coherent.

This explains why Marxist ideology disappeared immediately after the fall of the Wall. Mastering the jargon was of no help in the new system and so there was little to say.

Why is this important? It is important because most people think that ideologies are derived from content. Popper, for instance, believed that ideologies can be criticised rationally and using arguments. The truth is that the content of an ideology is completely irrelevant.

Modern theories of totalitarianism, for instance, the theories of Hannah Arendt, are not about content, but about the techniques used to gain control over a society.

It is also not true that ideologies always present a clear vision of an ideal society, as Popper states. This would mean that they are always "idealistic" in a certain way, something that is sometimes true for certain "leaders", but irrelevant for mobilisation of the masses. Related to the mobilisation of the masses, it is only important that they are able to establish a system of incentives, permitting control of the behaviour of people or at least of a certain group of people.

To put it simply, it is not the ntent that stabilises ideologies, but behaviour. When viewing these videos: German army (west) , German army (East) , Spanish army and French army we rapidly realise that the important thing is the rite, not the "content". The defenders against "imperialism", the East German army, was easily and unproblematically integrated into the imperialist West German army. No public discussion took place and no one wondered about this step. In other words, nobody takes ideologies seriously from a content point of view. It seems logical and normal to everybody that people can be integrated into any system under the condition that the system has incentives that allow for integration and punish deviance.

Contemporary textbooks on economics and academic curricula are a special case. It is quite clear to everyone that the public does not agree on economic issues. It is not difficult to find articles describing the public view on economics. Here is one: Do we need economists?, but within ten minutes one could find a thousand more although the website linked above is intelligent. (Examples such as this one are not so readily available.)

It is obvious that the big differences we find in public discussions related to economic issues cannot be resolved. Discussing these differences in the classroom and not being able to give clear answers would undermine the status of economics as a science. The best thing they can think to do in this case is to abstract from all problematic issues.

The differences between Neoclassical theory and Keynesianism are not so large if Keynesian theory is presented in the form of the IS-LM model, presented as a Neoclassical synthesis. If the original text of Keynes were compared to Léon Walras, it would be clear that we are dealing with incompatible points of view.

Textbooks about economics do not try to resolve the contradictions, they try to mask them. If they acknowledge that there are different opinions and that they are not able to resolve the contradictions this would undermine the status of economics as a science.

The problem is that in the real world the differences are obvious and it is thus of no help to mask these differences. This is why academic economics plays no role in public discussion. Discussions about trivial things like the pareto optimum, with some mathematic modeling that make it look more intelligent, are irrelevant. It is obvious that concerning trivialities different opinions does not exist, but trivialities are not relevant. Nobody cares about them.

To illustrate this point with an example: Public opinion tends to see a contradiction between a free market economy in which the allocation of resources is controlled by prices, the strength of market economies, and Keynesian expansionary fiscal policy. Some examples of this strange view can be seen here: The Free Market - Adam Smith , Keynes and Hayek. It is obvious that if fiscal policy is so expansionary that it takes all the resources we get a socialist economy. Fiscal policy, actually not very important in Keynesian theory (actually it is only one conclusion among many others that can be drawn), should be effective and must be of an investive character and not only finance consumption. This is much more important than the crowding out effect (which doesn't exist as central banks can produce any amount of money) discussed extensively in all textbooks. Real economic debates are not concerned about "crowding out" effects. Never. They are concerned about the distortion of allocations. This is the problem that should be addressed.

It is true that the IS-LM model seems very elegant and, by introducing some mathematical modeling, can appear scientific, but it masks the real problems.

It is even possible that, at the end of their studies, graduates in economics fail to understand the meaning and strength of a free market economy, as well as Keynesian theory. By trying to mask the differences, by trying to present economics as a well-established science without contradictions, it is not clear where the differences are. Before we can start to reconcile the contradictions, we must understand them.

Milton Friedman offers a strange example of this. Milton Friedman is actually a supporter of the free market (in its most radical form (for example, the mechanism controlling the economy in the narrow sense of the term should control things like public schooling, health care and so on). Nevertheless, he did not entitle his book the Free Market as a Guarantor of Freedom, but chose instead, Capitalism and Freedom. By capitalism we currently understand an economic theory which assumes that capital is the moving force of history. "Capitalist" production accumulates more and more capital by squeezing value added from the workers , in other words they keep the difference between what the workers need to survive and the value they produce.

The Ricardian capitalist is not characterised by the fact that he is an entrepreneur as described by Jean Baptiste Say, but by the mere fact that he possesses capital or more precisely: Accumulation happens without the intervention of an entrepreneur, one can even say that it accumulates alone. In his videos, see Milton Friedman - A Conversation On The Free Market, Milton Friedmann underlines the importance of personal initiative. However, if capital accumulates by itself, then no freedom is needed because capital does everything alone. (By the way: If capital accumulates alone, there is no freedom because people can only adapt themselves to the decisions of capital.)

But this is not even the central point. The central point is that the notion of capital suggests that capital (in other words, past income that has been saved) is necessary for investments. This is a central point, because it is incorrect. We will see later on, when talking about Joseph Schumpeter, that money is needed for investments and money is something completely different than capital.

To put it simply: a car can be bought with capital, with saved money from past income. But it can be bought as well with a loan to be paid back in the future. In this case "savings" are necessary in the future. This has a heavy impact on the interest rate because it is not very clear if the interest rate is really the price for money as we read and hear everywhere.

It may sound strange for the adept of Milton Friedman, but Milton Friedman is an incorrigible Marxist.

From a marketing point of view the title of Friedman’s book is good. It sounds much better than Decentral Information Processing Through Prices Instead of Central Planning. It can also be assumed that the title contributed to the book’s success (half a million books sold) because its success cannot be explained by its content, which is rather trivial.

Besides this, from a marketing point of view, the title is good. It sounds much better than "Decentral Information Processing Through Prices Instead of Central Planning". It can be assumed that the title contributed to the success of the book (half a million books sold) because the success cannot be explained by the content, which is rather trivial.

It is clear that the possibility to make profit must exist, otherwise market players would not react to signals of scarcity. But the meaning of capitalism is different. As becomes obvious if we read David Ricardo, Karl Marx or Léon Walras, capital reacts alone to the signals of scarcity. There is no need for human beings. There are only production factors, labour, capital and land. The only ones who realise that a market economy can only work if there are entrepreneurs and who underscore their role in a market economy are Jean Baptiste Say and Alfred Marshall.

If capital reacts alone to the signal of prices, things like education, skills, know how, research and development do not play any role. It is therefore obvious that these notions are absent in the works of David Ricardo, Karl Marx and Léon Walras, whereas Jean Baptiste Say dedicates several chapters to this topic.

Modern textbooks on economics follow more the Ricardian model for several reasons. Firstly, the impact of training, skills, technological progress, innovation, creativity, research and development cannot be described using mathematical modeling, the methodological paradigm of economics. Abstracting from dynamic elements of this kind simplifies the task. With this approach we do not get a picture of a free market, instead we get a model which can be described mathematically. Capital and labour become natural forces which can be controlled through prices.

It is a strange that Keynes is accused of distorting the allocation of resources. The risk that this happens exists, no doubt, especially when economists with no real working experience decide about the use of resources. But Neoclassical theory, perceived as the adversary to Keynesian theory, presumes that capital will flow automatically to its most profitable use. Total equilibrium is obtained without any problem. Actually, no market (defined as a process of trial and error) is needed. The question which arises is this: If it is no problem to achieve total equilibrium, if the capital flows alone to the best use, why should it be a problem for public employees to find its best use? It should be enough to simply do nothing.

The problem is that the risks of Keynesian theory, as perceived in public debates, is not even present in economics textbooks. The real problems, as they are perceived by the large public, are masked. We can see that more easy if we take a look at the IS-LM model. The IS-LM model shows the effects of an increase of public spending, but no distinction is made between consumption and investment.

Economists will say that this is not true because there has been great progress in modern times, and will add that game theory or the institutional economics takes into account more complex issues. takes into account any more complex issues. The problem is that life is not about talking, life is about doing. If we know that the entrepreneur plays a decisive role in a market economy, the question arises of how we can get more of these kind of people. See can this nut be cracked?. The fact is that academic idiots have no working experience and no clue of the real world and thus the only thing they can do is to abstract from the real world that is unknown to them. Hence we have some sort of escape from reality through mathematic modeling. Mathematic modeling is an elegant way to abstract from everything that is unknown and cannot be mathematically modelled. In this way ignorance takes on a scientific appearance.

The content of an ideology is irrelevant for the constitution of an ideology. Much more important are rules that are consciously or unconsciously present, which only can be respected by people who have been fully permeated by that ideology.

Content, in other words, something that can be discussed with arguments, is a risk for ideologies.