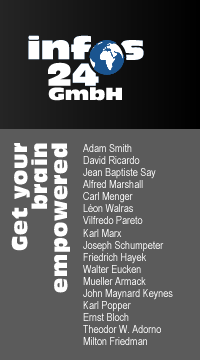

1. classical economy

2. neoclassical economy

3. Karl Marx

4. Joseph Schumpeter

5. ordoliberalism

6. keynesianism

7. critical rationalism

8. philosophical criticism

9. monetarism

We have seen fundamental changes in the last ten years and these processes will continue in the next decade. The mass media will loose in part, their control about the public opinion; the internet will allow a better control over politics and more and more data will be accessible because everything that was stored on the internet will remain there and therefore, automatically more and more background information would be available.

At the moment, more money is spent on printing and distributing the content than for the production of content. If the costs of printing and distributing disappear, there is more money for the production of high-quality content.

The news industry is aiming nowadays to deliver the same content to a maximum of people, see The Culture Industry: Enlightenment as Mass Deception, what is the most profitable thing they can do, will disappear in the long run. It is not profitable to produce news, actually newspapers produce news, it is wrong to say that they just tell them, for 10,000 readers if these readers have to buy a newspaper. However, a website with daily 10 000 users is profitable. 10 000 users are reading each of them and 5 pages make more or less 2800 euros or more or less than 3000 dollars.

In the future we will need fewer people working in the physical production and distribution of newspapers and more people producing content. The same thing applies to television.

The answer to the question if this 'nut can be cracked' is, therefore, yes. Due to technical changes, the economic model is not longer working. Until now, it was well possible for a different newspaper to sell the same content because mostly in a particular region there were only one or two newspapers and, therefore, nobody realised that they all offer the same content and everybody took it for granted that the news they deliver is the most relevant ones. If all the newspapers are accessible from every part of the world, people become aware that the content is always the same and largely consists only of texts delivered by press agencies as DPA/REUTERS/AFN, etc.

The discussion about Google is funny in this context. Google is reproached of having created a monopoly, which allows him, by manipulating the item list to influence public opinion. Besides the fact that it is unclear why Google should have an interest to do that, it is strange that this kind of reproach was never made to the mass media like television, radio and printing press owned in large parts by globally operating media companies. The real problem seems to be a different one. Google doesn't care who is behind a website; whether it is a big media company operating worldwide or an individual is of no importance in the Google ranking. Google does not care if he puts his ads on the website of a big company or a small company; he always earns the same amount of money. At the other side, it is economically of crucial importance that the best websites can be found. Otherwise, people would go to Lycos, AltaVista, Bing or Yahoo.

This naturally changes the rule of the game. Thirty years ago, it was not possible for single individuals to publish their information. Very, very few people could print 10 000 newspapers every time they had some information they feel the need to publish. Nowadays this is quite easy. If Google is the access point to information and not the kiosk around the corner, the mass media have lost their power and with the power the financial resources.

The mass media try to redefine their struggle for existence in a fight for liberty. The truth is much simpler. A monopolistic organised industry is losing their power.

Economists can play a role in this process because almost every problem in the focus of public discussion, social welfare, public education, economic growth, change of the population pyramid, international current account imbalances, is at least in part an economic problem or have economic aspects.

The basic idea of neoliberalism is transparency. It is obvious that the most transparent system is a market. It is true that the more power is transferred to governments, the higher the risk of mismanagement and even abuse of power. (We don't discuss the fact that neoliberalism is as well a mere ideology. We discuss the rationally comprehensible aspects of this tendency.)

However, neoliberalism appeared before the internet. It is clear that a news industry focusing on some few topics delivered to the maximum of people is not able to exert any control over politics. It is, even more, plausible that an industry of this kind became the instrument of politics because this is more rewarding. Information that politics don't want to be published are more interesting, apparently, but more investigation is needed to get them. We have much more news about things some people want to see published, sports, for instance than information that some groups don't want to see published.

A similar control as the one achieved be the mechanism of a free market economy can be attained by transparency. That means for instance that the public budgets must be published in a structured way and explained. Furthermore, it must be analysed it the goals which were to be attained has been actually attained.

To learn how to this is, it is not difficult to find other projects of this kind, more helpful and offers more professional options than microeconomic game theories. It might be interesting and entertaining but is completely irrelevant in practice. In order to get sufficiently qualified to get a job, studies must focus on relevant things. If someone has nothing to do in his spare time, he can buy a book about microeconomic game theory.

The reason this kind of thing was introduced to the academic curricula is that more complicated and complex things like mentioned before, require cooperation with other faculties, the cooperation of public administrations, which are eventually not cooperating and so on. A little creativity is needed to teach game theory, the only thing to do is to buy a book and read it.

For people with little or no experience as an entrepreneur, it is easier to make the first path in this direction with a backing institution. No entrepreneurship qualities are needed to read a book. This can be done at any time.

The next problem is the style of writing. Students only learn to write "papers". The way this kind of "papers" have to be written is highly standardised but is of no use when it comes to writing for a broader public. The opposite is the case. When writing "papers", students "unlearn" to write for the more general public.

If economists want to have a real impact on the public debate, they must be able to explain their ideas as clear as possible. Even if we don't agree with the ideas of Milton Friedman or Friedrich Hayek, we have to admit that "Capitalism and Freedman" from Milton Friedman or "Road to Serfdom" from Friedrich Hayek are well written. Their ideas may be wrong, we will discuss about this topic later in this manual, but the message is easy to understand.

Papers in economics, in general, get better marks than some mathematical equations or when functions are included. It is not necessary that they contain new information. It is enough if they resume what they have already said before in plain words. It is supposed that a text looks more scientific if there are some mathematical equations or functions included. Sometimes a nice graphic looks pretty as well. In general, this is not very useful for the reader. If he already got the idea, he doesn't need the equation, and if he didn't understand the message, it would be better to give a better explanation. The aim of an equation, or a system of equations, is not to explain something, but to deduce an unknown parameter from known ones. Neither a mathematical function nor an equation system explains the casual relationship between the different parameters involved. It only supposes that a stable relationship exists. In school, we have seen a lot of equation systems and functions, very often out of any context, because now, some background is needed to do some mathematical exercises. It is, therefore, impossible to actually prove a cause and effect relationship with mathematical equations or functions. Mathematical equations or functions can only describe an existing relationship, but not explain it.

It is therefore well possible that a reader is impressed by a lot of mathematical functions and equations because it looks very scientific, but he will not be convinced. If he has a doubt about the supposed casual and effect relationship, he can't be convinced with mathematical functions or a system of equations, because this system of equations or mathematical functions doesn't contain more information about cause and effect relationship already explained in the plain text. Mathematical equations and functions follow the rule "if you can't convince them, try to confuse them".

It is not clear who invented the fairy tale that the General Theory of Employment, Interest and Moneycontains a lot of mathematics. Actually, there is no mathematics at all, and we will see later on, that the more "mathematical" presentation of the Keynesian theory, the IS-LM model is an inadequate simplification of his theory and responsible for the reduction to some simple ideas, expansive fiscal policy, of his theory.

"Professor Max Planck, of Berlin, the famous originator of the Quantum Theory, once remarked to me that in early life he had thought of studying economics, but had found it too difficult! Professor Planck could easily master the whole corpus of mathematical economics in a few days. He did not mean that! But the amalgam of logic and intuition and the wide knowledge of facts, most of which are not precise, which is required for economic interpretation in its highest form is, quite truly, overwhelmingly difficult for those whose gift mainly consists in the power to imagine and pursue to their furthest points the implications and prior conditions of comparatively simple facts which are known with a high degree of precision. " John Maynard Keynes, Essays on biography, Alfred Marshall, |

It is characteristic for economics that nobody reads the original works. Not Wealth of Nations of Adam Smith, not Principles of Economics of Alfred Marshall and not General Theory of Employment, Interest and Money of John Maynard Keynes, to name the most important ones.

Obviously this is not the case in physics, chemistry, mathematics or biology. Nobody reads for instance the original work of Gregor Mendel about the Laws of Mendel.However, this case is different. In natural science, some basics are universally accepted, and the interpretation is not controversial and if the accuracy of a thesis is confirmed every day, there is no need to question it and it would be a waste of time to study the workings of Ptolemy to find out if the sun turns around the earth or the earth turns around the sun.

The situation is different if there are two or more interpretations of the theory of an author. In this case, one should know what have been actually said by the author the debate is about.

The methodological paradigm is not irrelevant for the constitution of a science. The methodological paradigm decides what is going to be studied and how it is studied. If physics is the methodological paradigm, as it is the case in the neoclassic economy,only topics will be studied which can be studied with the methods of physics, that means with mathematical modeling. Things that can't be studied with this model are simply ignored or simplified so much that they can be studied with this model. Technical progress, for instance, appears in textbooks of economics only as an exogenous parameter or not at all.

Textbooks of economics nowadays are very different from textbooks of other social sciences like politics or sociology. Textbooks of economics pretend to have a certain amount of "economic laws" as well proved and stable as natural laws and, therefore, the same textbooks are used all over the world. This impression is strengthened by the use of mathematical modeling. The question if mathematical modelisation is possible in this case and fits with the object to be analysed is never discussed.

(The reader can do a quick research with Google, putting mathematical modeling and economics. He will find a lot of articles about the necessity of simplifying the reality in order to test it against reality and so on. The problem is that a model that doesn't contain the crucial problems is worth nothing. If insecurity, to give an example, is the crucial problem, a system of the equation describing the Walrasian total equilibrium is worth nothing. If there is no risk or no insecurity, all entrepreneurs are equally well informed, all preferences of the consumers are known, no sudden chance in the size of the market, etc. then perhaps we get a total equilibrium and labour, and capital is allocated in a way that the marginal product is the same in any use.This would be a trivial world. So trivial, that a central planning commission would be more efficient than the decentralised information processing through millions of individuals. Unfortunately, this is not our world, and it is not even clear, why an entrepreneur is needed in the Walrasian world. If the central planning commission knows the marginal product, they can fix the prices at this level. No competition is needed. Why we need a market as an exploration process, if we get to the same result resolving some equations?)

The statement of Keynes, see paragraph above, is a little bit obscure, but perhaps very true, although difficult to prove. It is possible that there are people who are better in deducing from some simple facts large conclusions and others, who are better in finding tendencies in the chaos. Nevertheless, it seems that Keynes had a very clear idea of what he wanted to say, because he said the same thing about Alfred Marshall, with whose economic theory, apparently, he didn't agree at all, but who he respected very much as a person.

It is strange that a person like Keynes uses the word "intuition" (...the amalgam of logic and intuition...), being himself kind of a rational machine. However, in some sense "intuition" is not really irrational. A novel, for example, at least at a certain level, describes, for instance, the impact of nature or the social environment on the behaviour, feelings, aspirations and so on individuals. These relationships are not described in a rational way, not like laws of the type "if the social environment is like that, the individual will behave this way". Nevertheless, very often this kind of novels are understood by millions of people. What we generally assume concerning rational thinking, that it can be understood by other brains, is, therefore, valid for "intuitions" as well. Paintings from Edward Hopper can be understood by millions of people; there must be therefore a truth in them although this truth exists only because millions of people had made the same experiences. If, generally speaking, works of art were just arbitrary, with no inherent logic at all, they wouldn't be "understood". We don't know what "intuition" is, but it can be denied that it exists.

In economics "intuition" can mean to compare a theory with all the eventual scenarios, in reality, and taking into account all relevant parameters (...wide knowledge of facts, most of which are not precise...). It is easier for someone with little working experience, most of the academic economists, modeling something, than for people with more experience, because the first ones are not even aware that something is missing in their model.

Mathematical models can be used, but only if all the relevant parameters are part of the model. If for instance a model describes the neoclassical equilibrium in the labour market, the wage is equivalent to the monetary marginal product of labour, we have two problems. The first one, that the message is so simple, that there is no mathematical model needed to understand that. It is easy to understand that no entrepreneur will hire more workers if the value of what they produce in inferior to the wage they earn. This "law" is valid in the USA, in Bolivia, in Algeria and Sweden. However, that's not the interesting point. The conclusion of this is in general that unemployment is the result of too high wages and can be reduced by reducing the wages.

The model as well the conclusion is the result of a certain type of thinking. Mathematical modeling supposes that structure of the economy remains unchanged. If we suppose qualitative leaps or mathematical modeling is difficult because this is unforeseeable and can't, therefore, be taken into account in a model. Therefore, it is clear, that qualitative leaps in the productivity of labour is excluded and, therefore, the only solution is a reduction in wages.

If we assume that the productivity of labour can be increased, the wage can remain as it is and full employment can even be attained with higher wages. But obviously increasing the productivity of labour requires more intelligence than just reducing wages. If we talk about increasing the productivity of labour, we talk about changes to be made in the education system, we talk about research and development, transfer of know-how and so on. We talk then about complicated things.

The debate on these topics seems to be ridiculous to the champions of mathematical modeling, but from a historic point of view, problems were never resolved by reducing wages. The solution was always an improvement in productivity and in a lot of regions a reduction of wages can't be the solution because wages are already at subsistence level.

Movements like the post-autistic economics is confronted with the problem that academic economists are not able to change, even if they want. Therefore, they want to change. If they really concentrate on the relevant things, the corridor within the limits thereof is the truth, as shown in this manual (to be clear, we have a clear idea how economics should be taught), economic teaching in the narrow sense of the term would be reduced to two years and in the rest of the time it would be up to the students in what field they want to specialise themselves. However, since academic economists have no working experience, they can't initiate interesting projects. Therefore, they must be substituted by more qualified people.

If we accept that factors outside of the narrow world of economics have a crucial impact on the economy economics loses its role as the "queen of social science" and other social sciences became more relevant. In this case, one must think as well about the reallocation of resources.

There are a lot of reasons why economics will not be able to reform itself. The first reason is that the academic staff controls the personal recruitment, and they will not accept that someone with different opinions get in. Second they are simply not able to change the academic curricula. Third, saying that economics alone can't explain the economy means that other social science will get a better result and therefore, it is obvious that a redistribution of resources is needed. All that let assume that only an intense pressure from on politics can change the system.

It is not very plausible that economics will reform itself. Reforms are only possible through a large public debate, that obliges politics to change the organisation of the studies of economics.